Market Update July 2024

Industry Market Trends

GENERAL MARKET TRENDS

POTENTIAL MARKET DISRUPTORS

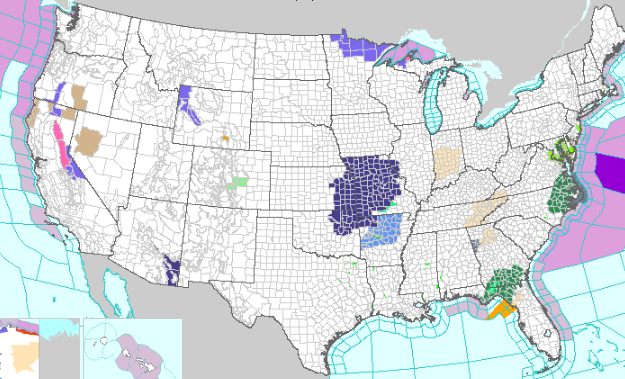

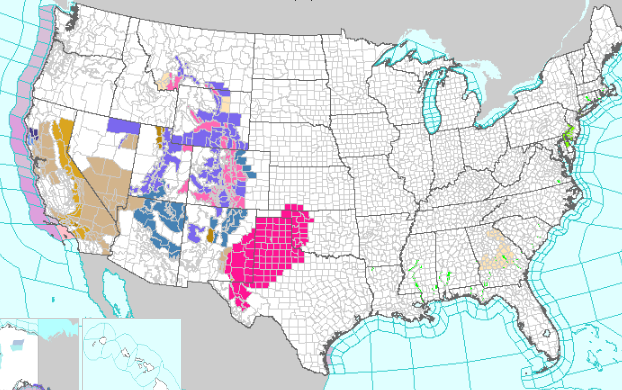

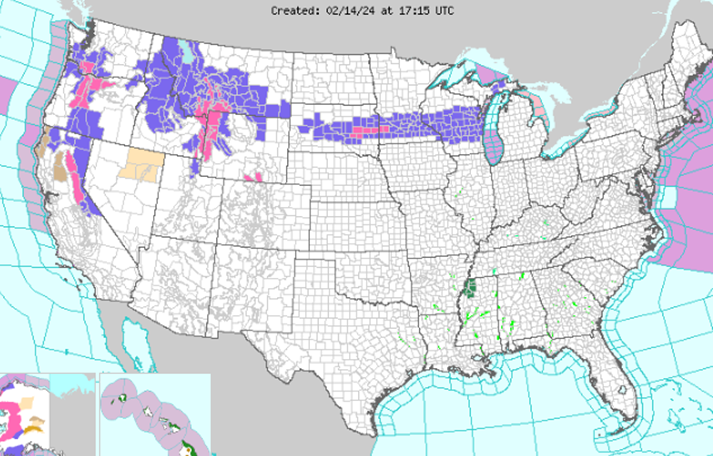

- Current Market Surge: The Midwest is beginning to experience its seasonal surge in freight demand due to agricultural shipments and holiday trends, this is causing relatively tighter capacity and higher spot rates for Reefer and Dry Van equipment. Ongoing construction projects are driving up demand for Flatbed equipment, particularly in Texas and California.

- Market Predictions: We expect the freight market to remain relatively tighter in the Midwest and Southeast over the next month, with continued high demand for Reefer and Flatbed equipment. Spot rates are likely to increase further as we approach the July 4th holiday, driven by increased consumer demand for summer-related goods. Customers should plan for potential delays and higher shipping costs, particularly in regions affected by seasonal trends and ongoing construction projects. Post-July 4th, the freight market is expected to stabilize but maintain elevated activity levels due to ongoing produce shipments and construction projects. Key produce regions will include: California, Northern Florida, Texas, and the Midwest

- July 4th Holiday Impact on Freight: As the July 4th holiday approaches, we anticipate elevated freight costs, particularly in the Midwest, due to the peak grilling season. This period typically sees increased movement from meat processing plants, driving up demand for Reefer equipment. Dry Van freight will also experience a surge in activity, moving products such as alcohol, condiments, and other summer-related goods. This seasonal increase in demand pairs with the current spikes in produce rates, contributing to the expected rise in freight rates. Overall, the upcoming holiday period will likely amplify the seasonal trends already observed, leading to higher freight costs and relatively tighter capacity in key markets. This aligns with the typical patterns seen during summer months when consumer demand for various products peaks.

- Incident Surge and Commodity Targets: In May 2024, 272 incidents were reported, reflecting a significant 20% increase over the previous month and a 36% rise year-over-year. The primary targets remained food and beverage commodities, with a notable uptick in thefts of non-alcoholic beverages like sparkling waters and energy drinks, as well as hard liquor. Additionally, there was a marked increase in thefts of footwear, supplements such as creatine and vitamins, copper, and vehicle maintenance products including tires and motor oils.

- Evolving Theft Techniques: Sophisticated fictitious pickup schemes in Southern California have emerged, where groups use advanced methods to bypass identity verification and compliance tools. These methods include misdirecting freight to street transloads, which has become more common than public cross dock warehouses, allowing increased theft frequency due to the availability of box trucks and drivers. With these evolving tactics, an increase in cargo theft is anticipated in the coming months compared to Q1 2024

Ocean, Air, Port, and Intermodal Impacts

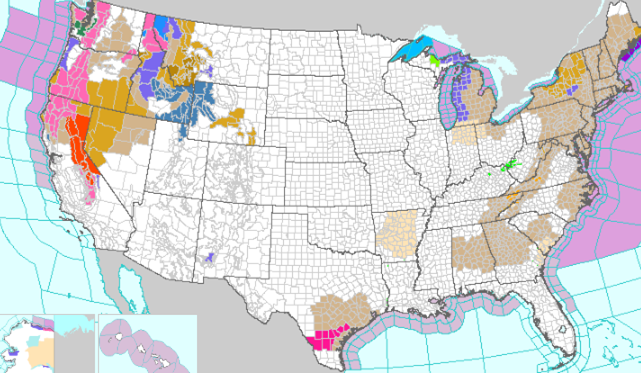

- Increased Port Congestion: Port congestion on the West Coast is growing again, particularly in the ports of Los Angeles and Long Beach. The number of ships waiting to berth has increased, leading to backlogs and longer transit times for shipments. This resurgence in congestion is primarily due to increased import volumes from Asia. Additionally, recent attacks by Houthi rebels in the Red Sea are causing diversions and delays in global shipping routes.

- Current Market Trends: Ocean freight volumes are increasing, particularly on the East Coast, as shippers reroute cargo from congested West Coast ports. This is leading to higher demand and relatively tighter capacity in the Southeast. Air freight demand remains strong, driven by high-value and time-sensitive shipments, particularly in the electronics and pharmaceutical sectors.

- Predictions and Impacts: We anticipate continued high volumes and congestion at major ports, particularly on the West Coast. This will likely impact schedules and increase freight rates for both ocean and inland shipments. Customers should consider alternative routes and modes of transport to mitigate potential delays. Intermodal freight volumes are expected to remain stable, providing a viable option for long-haul shipments.

Seasonal Trends

- Seasonal Retail Activities: Seasonal retail activities, including back-to-school and holiday shopping, will drive up freight volumes and capacity demand. Key regions are expected to experience increased demand, impacting spot rates and availability.

- Produce Season Impact: The ongoing produce season in regions like California, Florida, and Texas, is driving up demand for Reefer equipment. Customers should plan for higher rates and relatively tight capacity during this period. Specific crops expected to move include: California (grapes, broccoli, carrots, tomatoes, and strawberries), Florida (oranges and strawberries), Texas (avocados, tomatoes, and other vegetables).

- Construction and Flatbed Demand: Increased construction activities, particularly in Texas and California, are driving up demand for Flatbed equipment. This trend is expected to continue, impacting availability and rates. Projects in Texas, including the expansion of highways and new commercial developments, are significantly increasing the need for building materials such as steel, lumber, and concrete. In California, ongoing infrastructure upgrades and residential construction in urban areas are also boosting demand for flatbed services. Additionally, the Gulf Coast region, particularly Louisiana and Alabama, is seeing a rise in petrochemical plant construction, further straining flatbed capacity.

- Grain, Dairy, and Beverage Movements: Seasonal demand for grain, dairy, and beverage shipments is impacting capacity and rates, particularly in the Midwest, California, and New York. Key grains include corn and soybeans in the Midwest, while dairy movements are significant in states like California and Wisconsin. Beverage shipments, particularly alcoholic beverages, see increased movement during the summer months.

Transportation Events |

Upcoming Holidays |

|

|

BM2 NEWS

- Food Logistics named BM2 Freight Services, Inc as a recipient of the 2024 top 3PL & Cold Storage Providers award. How Top 3PL & Cold Storage Providers Cultivate Resilience in Transportation | Food Logistics

- Food and beverage is one of BM2’s largest verticals. Shipping nearly 10,000 truckloads in the last 12 months! Customers continue to trust BM2 when it comes to shipping food products due to our industry leading claims percentage of .25% (51 claims filled on 20,735 shipments for 2024). Know you are protected when you ship with BM2!

DID YOU KNOW

-

At BM2 Freight, we boast an industry-leading claims percentage. Only 0.25% of shipments result in a claim situation at BM2! Wondering why our claims-to-load ratio is so low? It’s because we implement a meticulous carrier onboarding and selection process, coupled with industry-leading internal procedures designed to prevent issues before they even arise. Trust BM2 Freight to prioritize the safety and security of your shipments.

INDUSTRY NEWS TO KNOW

- CargoNet | The cargo theft prevention and recovery network

- State of Freight Today (ftrintel.com)

- State of Freight: Fuller highlights connections between housing market and trucking – FreightWaves

- US ports by volume: How maritime cargo trends are stacking up | Supply Chain Dive

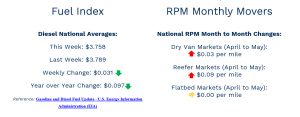

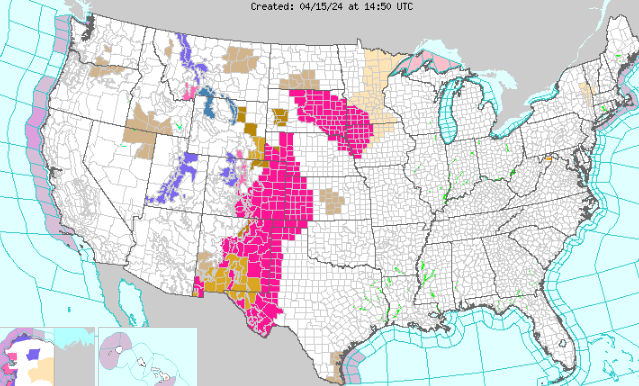

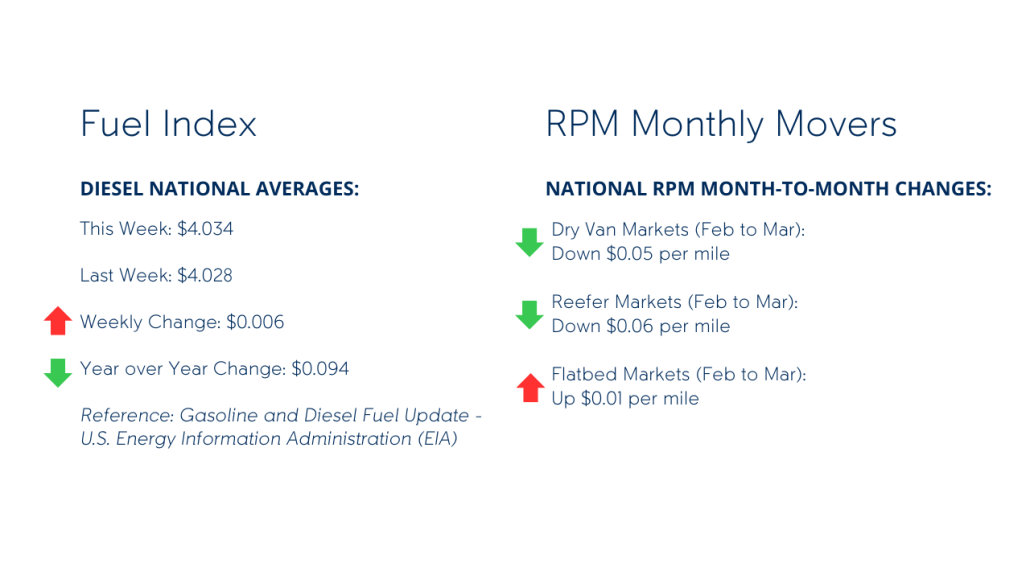

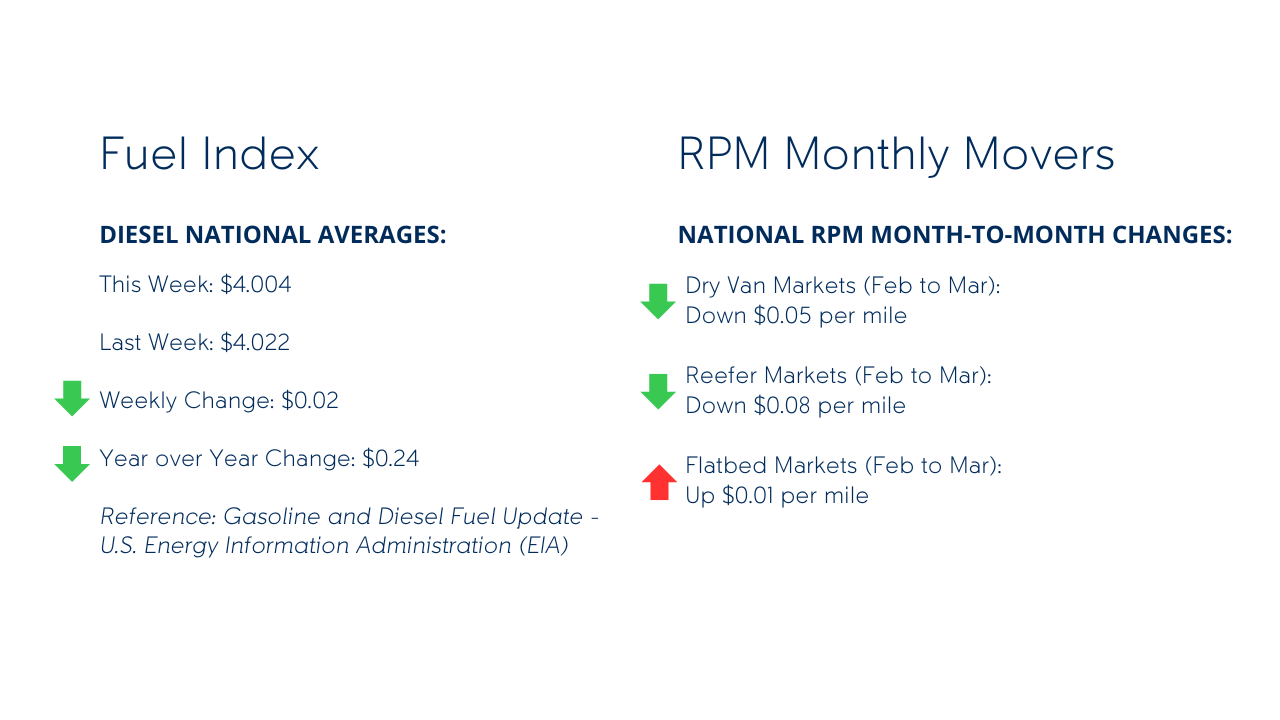

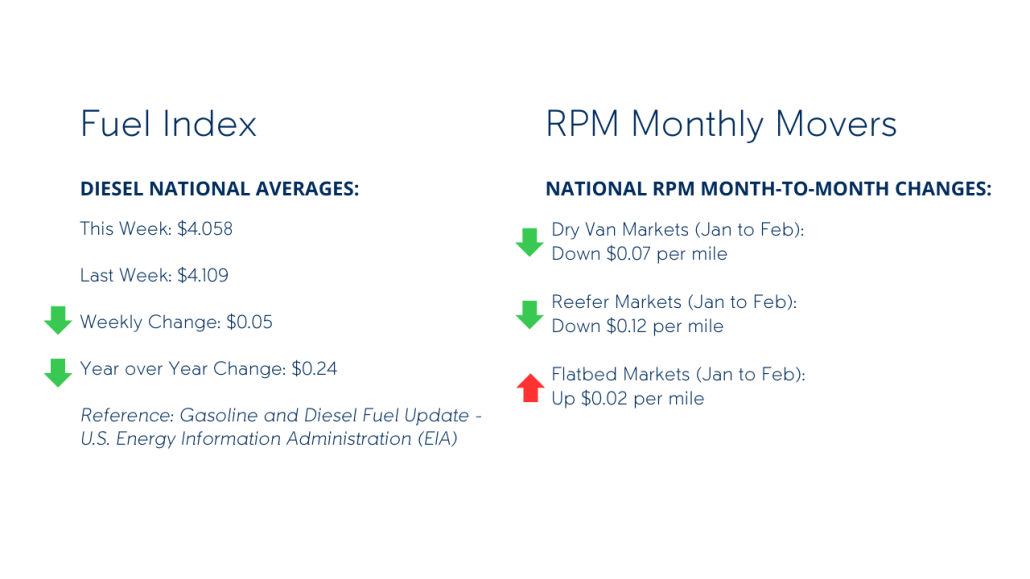

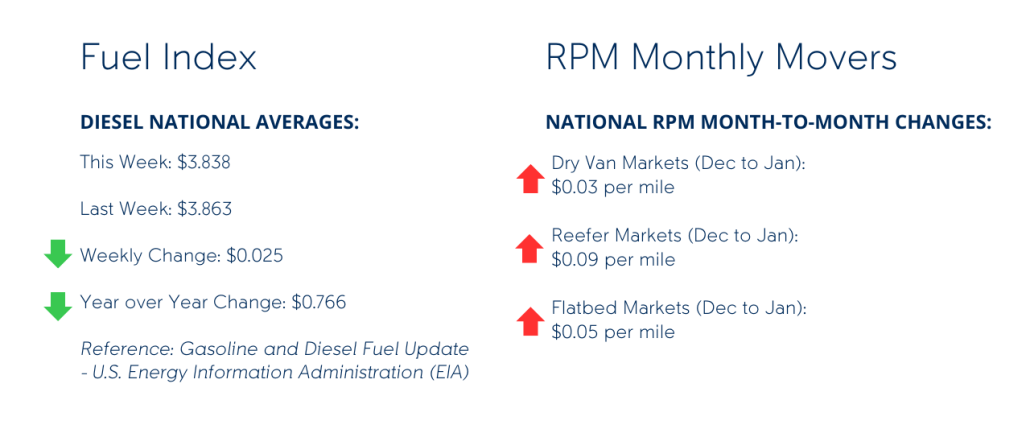

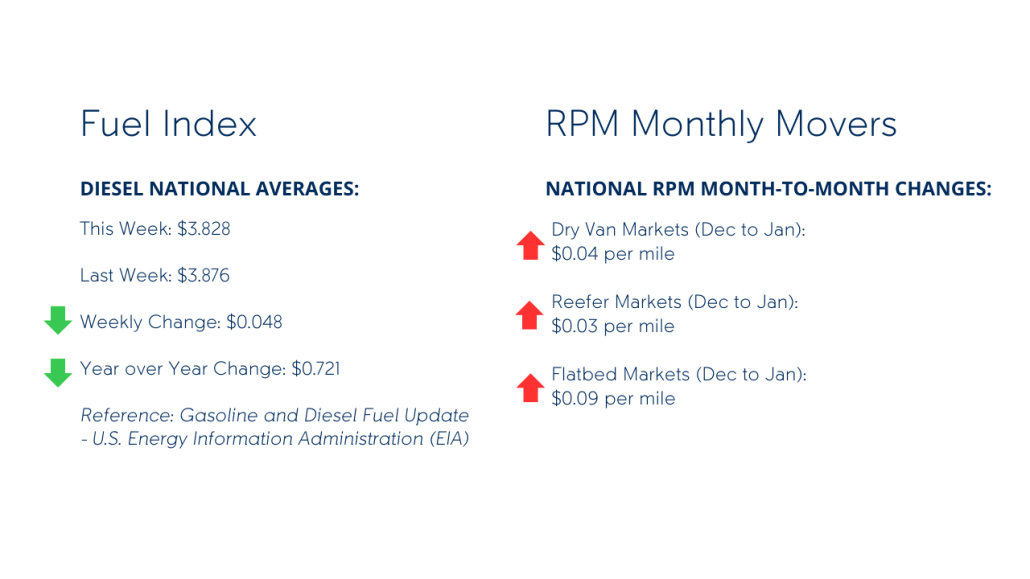

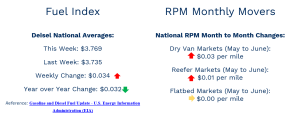

- Gasoline and Diesel Fuel Update – U.S. Energy Information Administration (EIA)

- Truck Tonnage Index (TRUCKD11) | FRED | St. Louis Fed (stlouisfed.org)

- All Employees, Truck Transportation (CES4348400001) | FRED | St. Louis Fed (stlouisfed.org)

- Producer Price Index by Industry: Truck Trailer Manufacturing: Truck Trailers and Chassis, Axle Rating 10,000 Pounds or More (PCU3362123362121) | FRED | St. Louis Fed (stlouisfed.org)

- Overseas shipping problems remain largely under consumers’ radar – FreightWaves