Market Update 1/30/2024

Logistics industry market trends you need to know.

General Market Trends

Potential Market Disruptors

Port Impacts:

- Red Sea Shipping Crisis: The Red Sea is experiencing a dramatic impact on global shipping and trade due to attacks against commercial vessels. These disruptions, caused by Houthi rebels, have led to a severe reduction in shipping traffic through the crucial Suez Canal, which accounts for a significant portion of global trade. The crisis is not only raising costs but also contributing to increased greenhouse gas emissions due to longer shipping routes. Container ship transits have declined drastically, and liquefied natural gas (LNG) carriers have ceased transiting the area altogether since mid-January 2024.

- Ocean Freight Market Dynamics: The dynamics of global logistics continue to evolve, impacting trade patterns and inflationary pressures. While ocean freight prices have seen a downward trend, recent developments like the Houthi attacks and Red Sea diversions have led to a spike in ocean rates across ex-Asia lanes. This has resulted in carriers responding with increased rates and surcharges, and the industry anticipates capacity shortages and congestion in the coming weeks.

- Optimism in US Ports: Despite global challenges, there is optimism among US port leaders for 2024. With unprecedented federal investment in ports, there’s a focus on expanding port capacities, reducing carbon emissions, and enhancing digital capabilities. Major projects are underway to modernize ports like Los Angeles and Long Beach, and there’s a strong focus on developing green hydrogen hubs.

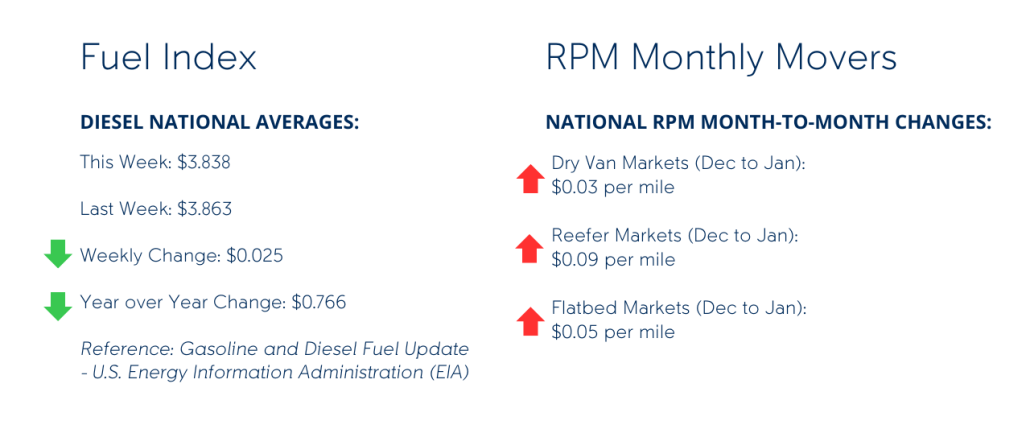

Seasonal Trends:

- Winter Weather Impact: With the onset of winter, expect disruptions in freight movement due to severe weather conditions, including snow and blizzard-like events.

- Produce Market Influence: The influx of produce entering the market in and from the Southwest and Florida has sparked an increase in rates, with the additional volume from the produce market, expect a tightening of capacity.

- 2024 spot rates have held onto their holiday momentum, only falling modestly by $.05/mile after the recent peak, suggesting an upturn in freight flow, while the ongoing Red Sea crisis and global events like the Chinese New Year continue to influence shipping routes and costs, potentially impacting future rates and market dynamics.

- Capacity: Continues to squeeze out of the market from its October 2022 and July 2023 highs.

Transportation Events:

- Manifest Vegas Feb. 5th – 7th

- AirCargo Conference Feb. 11th-14th (We’ll be on site)

- Food Shippers Conference (March 3rd-5th)

Upcoming Holidays:

- Chinese New Year (Feb. 10)

- Valentine’s Day (Feb. 14)

- Ramadan begins (March 10)

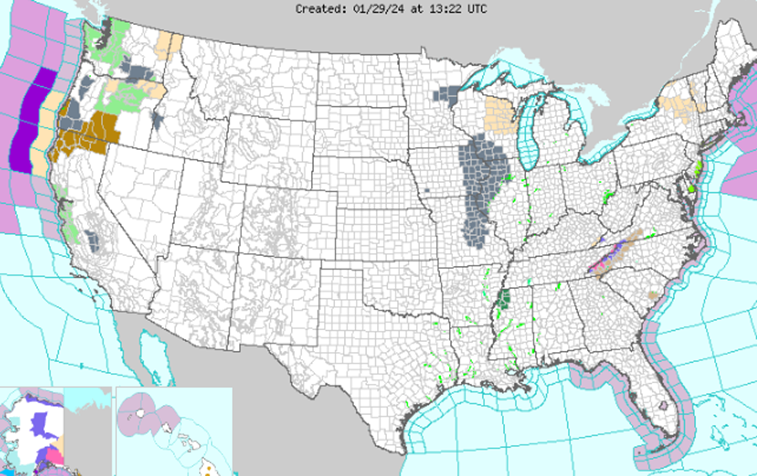

Weather Impact

- Northeast, Mid-Atlantic, Southeast, Gulf, Midwest, Great Plains, Texas, and Southwest:

- A warmer and sunny weather pattern is expected across these regions. High temperatures could reach the upper 50s to lower 60s, with a generally dry period until late in the week. Rain is not expected until late Friday at the earliest.

- California:

- Warmer and sunny weather initially.

- Atmospheric river storms expected, potentially causing high-end flooding, beach erosion, mudslides, and heavy mountain snow.

- Northern California at risk for flooding starting Wednesday.

- Southern California to experience very rainy conditions on Thursday.

- Pacific Northwest:

- Steady rains initially, with the atmospheric river storm soaking the region.

- Rainfall totals reaching 2-3 inches in the mountains and up to about 1.50 inches in the lowlands.

- The storm track expected to lift north, with another, stronger atmospheric river storm focusing on Vancouver Island and southwestern British Columbia, but also impacting northwestern Washington.

- WPC’s Short Range Public Discussion (noaa.gov)

Industry News to Know

- Crosswinds threaten soft landing – FreightWaves

- Why it still feels like a recession for many – FreightWaves

- Retailers have finally tamed their inventories: report | Supply Chain Dive

- Warehouse employment keeps falling — and more layoffs loom | Supply Chain Dive

- Logistics-Tech Startups Face Uncertain Future as Freight Slump Continues – WSJ

- India-US perishables trade soars as ‘political’ tariffs are lifted – The Loadstar

- Port of Long Beach cargo volumes rise 30% YoY in December | Supply Chain Dive

- Why truck drivers wait unpaid – FreightWaves

Like being in the know? Get our biweekly Logistics Market Report delivered straight to your inbox. Sign up here.

Leave a Reply

Want to join the discussion?Feel free to contribute!