Market Update 2/15/2024

Logistics industry market trends you need to know.

GENERAL MARKET TRENDS

POTENTIAL MARKET DISRUPTORS

PORT IMPACTS:

- Ongoing Challenges in the Red Sea:

- The Red Sea region continues to face significant disruptions due to military strikes against Houthi positions, affecting global supply chains. European importers are dealing with inventory shortages due to delays, while Asian export hubs face tight space and equipment availability.

- However, there are signs that conditions may be improving slightly as congestion levels remain minimal and carriers adjust to accommodate longer routes.

- The Red Sea region continues to face significant disruptions due to military strikes against Houthi positions, affecting global supply chains. European importers are dealing with inventory shortages due to delays, while Asian export hubs face tight space and equipment availability.

- Surge in Ocean Freight Rates:

- Ocean rates from Asia to North America have surged significantly, with West Coast rates increasing by 38% and East Coast rates by 21%.

- Despite these increases, there’s speculation that freight rates might be nearing their ceiling, especially with the Lunar New Year approaching and potential shifts in demand.

- Ocean rates from Asia to North America have surged significantly, with West Coast rates increasing by 38% and East Coast rates by 21%.

- Air Cargo as an Alternative:

- There has been a moderate shift towards air cargo due to delays in ocean shipping. China-North America air cargo rates climbed by 11% last week, indicating a response to the ongoing disruptions.

- This suggests that some shippers are exploring alternatives to navigate the current challenges in ocean freight.

- There has been a moderate shift towards air cargo due to delays in ocean shipping. China-North America air cargo rates climbed by 11% last week, indicating a response to the ongoing disruptions.

SEASONAL TRENDS:

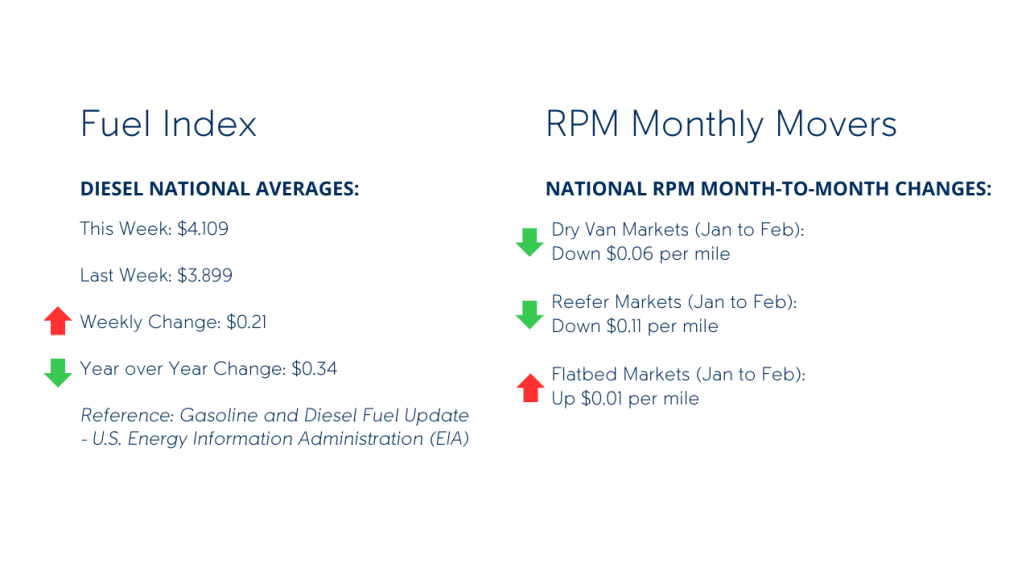

- Spot Rate Trends:

- Spot rates across the trucking industry, including dry van, refrigerated, and flatbed segments, have continued to decline for the third consecutive week as of the week ending February 9, 2024. This trend is part of a broader pattern of lower rates and reduced load activity compared to the previous year and the five-year average. Notably, dry van rates saw the most significant drop, reaching the lowest weekly spot rate since before Thanksgiving.

- In February, produce season typically starts in southern regions of the U.S. such as Florida and Texas, with these states becoming focal points for seasonal demand due to the influx of produce from Mexico and Latin America.

- The surge in produce shipping from these areas affects the freight market, notably impacting outbound spot rates due to the increased demand for transportation.

- Capacity:

- Continues to squeeze out of the market from its October 2022 and July 2023 highs, and accelerated in January of 2024.

TRANSPORTATION EVENTS:

- Food Shippers Conference (March 3rd-5th)

- International Roadcheck Week (May 14th-16th)

UPCOMING HOLIDAYS:

- Ramadan begins (March 10)

- Daylight Savings Time (March 10)

WEATHER IMPACT

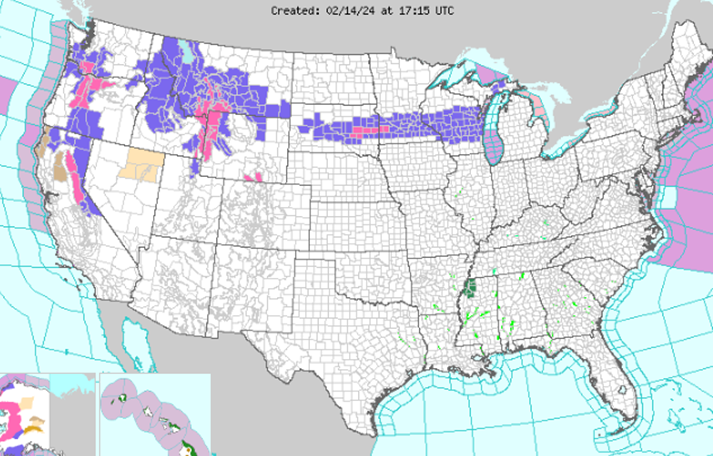

South, Mid-Atlantic, and New England Tranquil Weather:

- Following a strong nor’easter, these regions are expected to experience much more tranquil weather, allowing for a period of drying out. Below-normal temperatures along the Eastern Seaboard today will give way to milder air by Thursday, gradually returning to above-normal temperatures.

Northern Plains, Upper Midwest, and Great Lakes:

- Heavy Snowfall: A quick-hitting wave of low pressure is expected to deliver heavy, accumulating snowfall across the Northern Plains, Upper Midwest, and the Great Lakes today and Thursday. This system will move quickly, bringing several inches of snow and potentially impacting travel and daily activities in these regions.

West Coast and Intermountain West: Rain and Snow:

- The next Pacific storm system is set to bring locally heavy rain to the West Coast and significant high-elevation snowfall to the Intermountain West over the next couple of days. This will likely affect outdoor activities and could lead to hazardous travel conditions in mountainous areas.

Temperature Trends:

- Cooling Down: A cold front following the low-pressure system will bring modified Arctic air south from Canada, leading to below-normal temperatures across the northern Plains and Midwest by the end of the week.

WPC’s Short Range Public Discussion (noaa.gov)

INDUSTRY NEWS TO KNOW

- Dates for 2024’s CVSA Truck Inspection And Enforcement Blitzes Announced (cdllife.com)

- Warehousing Demand Is Starting to Shrink – WSJ

- Roadcheck to focus on tractor protection systems, alcohol and drugs – Truck News

- Trucking authority correction accelerates – FreightWaves

- New Jersey Lawmakers Raise Minimum Insurance | Transport Topics (ttnews.com)

- Warehousing Demand Is Starting to Shrink – WSJ

- US ports by volume: How maritime cargo trends are stacking up | Supply Chain Dive

- The long road to recovery – FreightWaves

- Peak season is multiplying: How can logistics respond? – FreightWaves

Like being in the know? Get our biweekly Logistics Market Report delivered straight to your inbox. Sign up here.

Leave a Reply

Want to join the discussion?Feel free to contribute!